Louise Bedford, share trading expert, author and co-founder of The Trading Game, provides her insights in a guest post on the KnowHow blog.

The two super powers in the investment game are property and shares. Some people feel that it’s a battle between these two vehicles, and that there is a clear winner. Well … you be the judge.

Personally, I believe it doesn’t have to be one or the other, it can and should be both. After all, one of the keys to successful investing is diversification.

If you’re a property investor and wondering whether share trading should be added to your mix, here are some key considerations:

Brokers vs Real Estate Agents

Brokers fall into two categories – the human variety, or online brokers. ‘Human’ discount brokers will talk to you over the phone and offer very cheap rates. However, they won’t provide advice or send you any flashy newsletters, and often you won’t be able to deal with the same person every time you make a transaction. Online brokers often charge a flat fee per transaction up to a certain value of shares traded (eg $50,000). Transactions can be around $19.95, so the sharemarket is a clear winner here.

Perhaps try offering your real estate agent $19.95 to sell your next property and see how far you get!

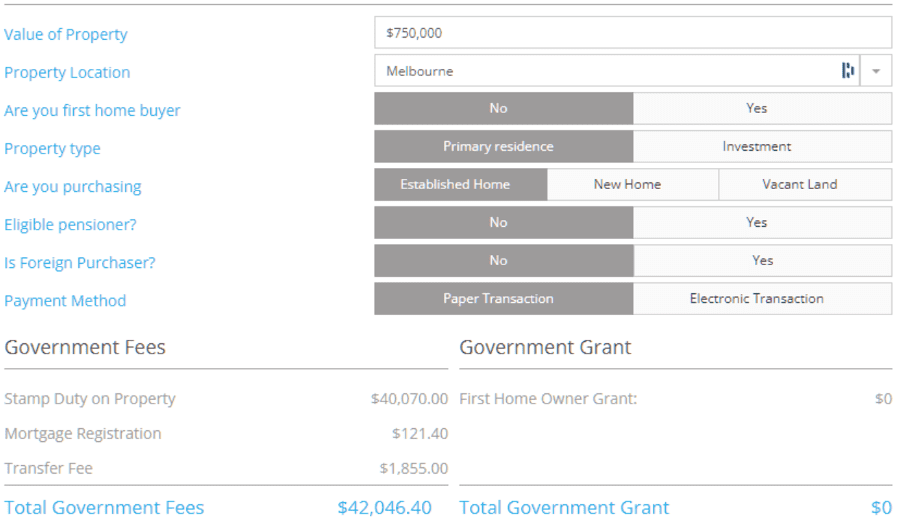

Let’s look at the cost of buying a $750,000 house in Melbourne (if you can find one). Here are some figures for you that show it will be a minimum of $42,000 in Government Fees:

Keep in mind that this list of costs doesn’t include:

- Mortgage registration fee

- Loan Application Fees

- Lenders mortgage insurance

- Solicitors and conveyancing

Also, taking into account the cost of real estate (given that the current median house price in Melbourne is $1,022,927), it requires a very large capital outlay. There is no such barrier in share investing as you can literally begin with a few thousand dollars. In fact, one of markets most successful investors Richard Dennis took a $1,600 account to $200M in ten years.

Because of this, share investing can also a great way for property investors to accelerate the process of raising the capital required for their next property purchase.

Software

Share trading is a fast moving machine, powered by software that uses shares-related data to produce charts and other forms of analysis. You should consider:

- Whether you can search the market easily for opportunities?

- What technical support is available if you run into difficulties?

- Are there training courses that you can attend to help you learn about the software?

- How user friendly is the manual and help files?

The software needs data to be able to produce the charts or figures that you will use to make trading decisions.

Many property investors keep some sort of excel spreadsheet to keep track of their expenses and gains. Things aren’t often standardised across the industry, as different investors have different views on what is important. In property the reality is the process is slower; you still have to find a property, inspect it, get an inspection, bid at an auction, and then spend time dealing with administration. Technology is the investor’s friend yet the property industry just isn’t there yet. Contrast this to the sharemarket. With shares, you can trade anything anywhere from your phone.

Technical vs Fundamental Analysis

Fundamental analysis may help to provide an indication regarding which shares are likely to increase in value, but will not provide a timing tool. Technical analysis will help to pinpoint when to enter and exit a trade, based on a chart showing share price action, but it won’t provide any information regarding whether the company is financially sound.

I tend to focus on technical analysis and share charts. I have tried using fundamental analysis to trade, but for me, the true indication of market sentiment is gleaned through looking price action displayed in charts, rather than analysing reams of ratios. Charts show whether people are willing to put their money where their mouth is.

Effective technical analysts wait for a trend to display a particular direction prior to taking action. There are a few simple rules. The first rule is that if a share is trending up – buy it. The second rule is if it’s trending down – sell it.

Most of property investing involves assessing things like location, the proximity of amenities, past property sales in the area and demographics. Interestingly, as a best-selling author of books on the sharemarket, I’ve found that people with a good property investment background are the fastest to make money in the sharemarket.

Plans

The best traders use a trading plan. It covers some basic issues such as your trading goals and objectives, which accounting structure from which to trade, and how you will handle your positions when you go on holidays. A trading plan must also cover 3 essential areas:

- Entry

- Exit

- Position Sizing

You can pick up my free trading plan template from www.tradinggame.com.au.

Effective property investors also rely on clarity around their goals, and this is a key reason why if you’re successful in the property arena, trading success may be closer than you think.

Other considerations

The world’s sixth richest person is Warren Buffet (worth $96B). Nine of the world’s top 100 richest are equity style investors of some sort while three of the top 100 are property investors.

Liquidity is an important consideration. A share trade can be exited at a moment’s notice with very little fuss. In fact they can be exited automatically for you at a given price and with some instruments it is possible to guarantee this exit price. Obviously the process is more challenging in property, which is another reason why property investors should consider diversifying with shares to create more flexibility.

Successful investors are among the most highly paid professionals in the world, yet many beginners expect to earn exceptional income immediately, without undue planning and effort. Profitable investing does not rely on luck. It demands the highest levels skill and discipline, and lucratively rewards the people who develop these qualities, regardless of whether they’re property investing, or trading the stockmarket.

It is crucial to seek the qualified advice and support of experts with a proven track record of success in their fields, and find the right diversified strategy for your personal needs and goals.

Written by Louise Bedford (www.tradinggame.com.au) . Louise is a full-time private trader and author of 5 best-selling books on the sharemarket including Trading Secrets and Charting Secrets. Download her free trading plan template from her website now and you’ll get her bonus 5-part audio course called ‘Trading Made Simple’.